It is early 2018, and Cigna announced its acquisition of Express Scripts, CVS Health recently announced its acquisition of Aetna, Humana its 40% ownership stake in Kindred[1], and Optum recently announced its DaVita Medical Group (formerly HealthCare Partners) acquisition. It was a mad rush to find assets or become buyer targets for each of the major healthcare corporations. These were major alignments of payer, provider, post-acute, and pharmacy-benefit management that set a precedent for future vertical integrations and alignment strategies to come. In 2022, rampant vertical integration is back but this is a much different environment.

Vertical integration is not a new strategy

- Corporations have rolled up and divested assets throughout American healthcare history. Some have found barrier-to-entry niches in certain site-of-care markets and have had sustainable high-quality care and profitable margins

- Some have had dominating market share with monopolies to maintain their market position

- Others have had rampant competition and have had to constantly evolve their business to be sustainable (or have failed altogether)

One of the traditional vertical integrators is the health system

Health systems today typically include more than one hospital and contain an array of services to meet the needs of the healthcare consumer. These services include (but not limited to):

- Physician services (whether employed or independent)

- Urgent care services

- Ancillary services such as lab, imaging, pharmacy

- Outpatient services, such as same-day surgery

- Acute hospital/inpatient services

- Post-acute services such as skilled nursing, inpatient rehab, or home health upon hospital discharge

Vertically aligned care services are more commonplace via a health system because healthcare is local

National companies scaling national models frequently fail to recognize that important lesson. Health systems that pay attention to “community” and “local feel” retain the network referrals over national brands. They invest in high-quality services to meet the needs of their local and regional populations and adjust year-over-year if projections are misaligned. While hospitals and health systems have been the center of the community for decades, they are not immune to disruption. This is especially true after the negative impacts of the pandemic: stressed finances and workforce beyond its breaking point.

The pandemic has stymied health system strategy and finances…while others advance

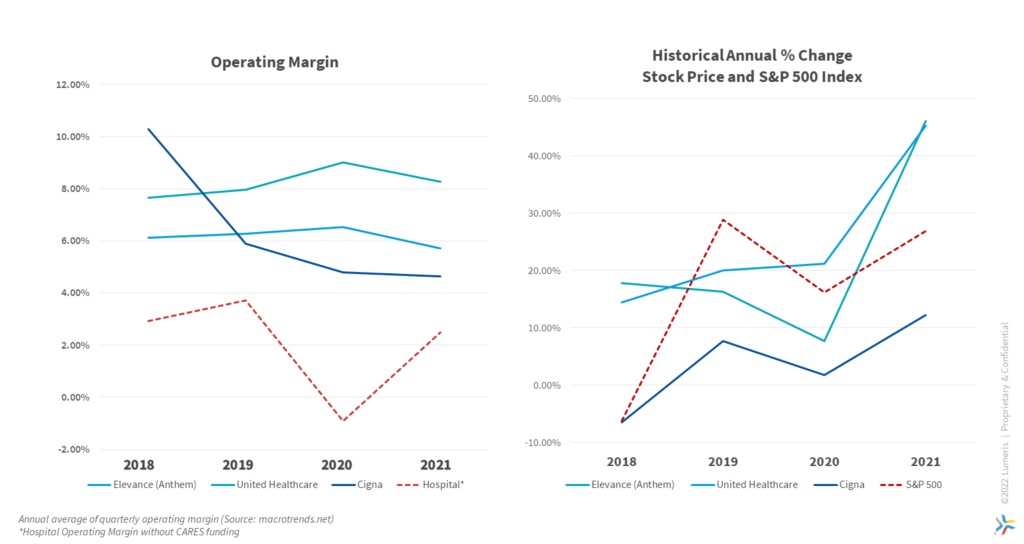

Notably, while health systems focused on supporting the U.S. public health during high COVID-19 prevalence and sacrificed profitable elective cases, others in the healthcare industry were planning to disrupt the value chain. During 2020 and 2021, the health insurance sector saw an average 24.28% increase in stock price and continued to maintain 6.5% operating margins, while hospitals averaged only 0.8% operating margins during the same time period[2]. Private equity-backed physician aggregators entered and penetrated metro markets seeking to divert care away from higher-cost settings (e.g. hospital and post-acute settings). Certain insurance-backed companies used their cash reserves to employ physician groups[3]. This was a relatively unnoticed healthcare trend throughout the pandemic.

While still in the aftershocks of the pandemic, 2022 has been a bearish year for U.S. equities through the first eight months. This has challenged overvalued and weak business models. The market responded and punished those companies accordingly. Meanwhile, it also opened a myriad of “discount” deals for those flush with cash to find acquisition targets for rollups. Today is different from 2018 when it was a bull market with relatively minor company weakness, and deal motivation was to avoid being last at the table without an insurance or provider services linkage. While there could still be some “fear of missing out” in the market today, during 2020 and 2021, the gap expanded between the major players looking to make a dent in healthcare services vs. the health systems with less market power and cash to conduct accretive M&A deals.

- One of the major draws of the bidding war for Signify Health in August 2022 was about home health and the scale of lives Signify currently manages. The move to the convenience of home care over a higher-acuity setting is a trend that major players are willing to bid on.

- Meanwhile, Amazon is planning to divest their Amazon Care telehealth & self-insured employer model to focus on brick-and-mortar value-based primary care. The Amazon Care pivot should not be written off as a “failure” by traditionalists. Amazon intends to be in healthcare and will learn the best way to do so.

- Lastly, Optum has historically focused on investments across the continuum of care to drive efficiency, quality, and scale across their membership. In 2019, UnitedHealth Group CEO David Wichman explained the company’s disinterest in acquiring or building hospitals, but rather the desire to expand their footprint with urgent care, surgical centers, and primary care offices.

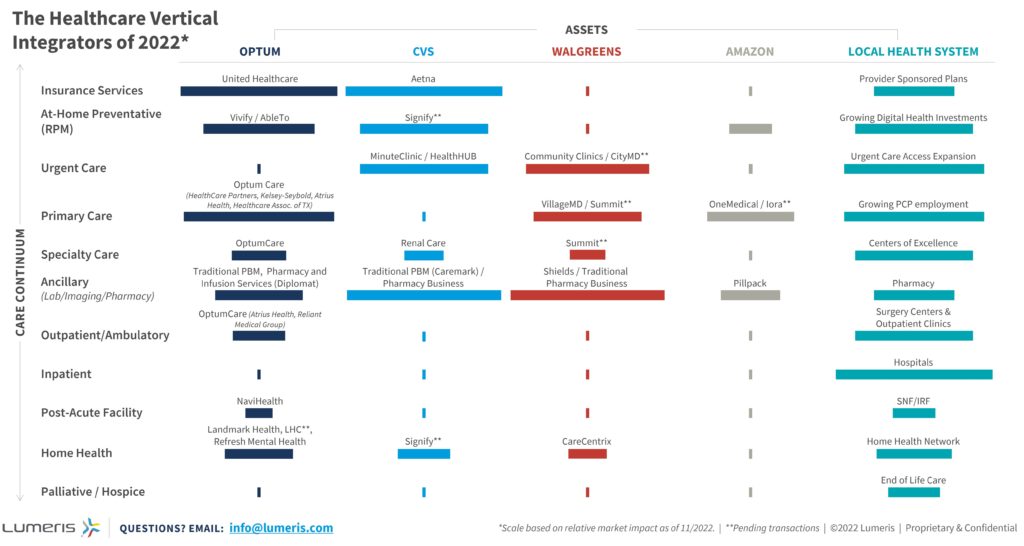

Figure 2: The Healthcare Vertical Integrators of 2022. Lumeris, 2022.

Note the consistency of Optum, Amazon, and CVS’ focus areas in the care continuum: invest in the preventative and technology-scalable areas but avoid sick care and high-cost settings of care.

- Amazon has the cash and business flexibility to try different entry points with the advantage of a loyal Amazon Prime brand consumer, but it is still far behind the vertical integration of its two peers. While their current footprint is comparatively small, their ability to collect large amounts of consumer data will almost certainly play a role in future healthcare endeavors.

- CVS has the pharmacy side well-managed, but it has more work to do in primary care beyond nurse practitioner-led urgent care settings.

- Optum is the most advanced vertically integrated entity and is the largest threat to the incumbent health system’s future sustainability.

To compete in a value- and consumer-driven vertically integrated future, health systems must evolve their business model

Preparing for a competitive, vertically integrated future starts with shifting the business model away from fee-for-service to fee-for-value. The major player’s business models operate on value as that is what aligns best to the consumer. Not every health system has the balance sheet to scale to the degree of these companies, but they can pick the right assets to own and the right programs and behaviors to instill.

Health systems can compete at the front lines by being the loyal, trusted care partner of their consumers, and coordinating them to health system assets at every stage of their health journey. Focus on keeping consumers healthy throughout their aging process, and if they need to move to a more advanced setting, health systems have the department scaled according to that demand.

While health systems are the incumbents, their barrier to entry is not bulletproof, and these market entrants are gearing up to change that. Be the only vertically integrated organization that matters: the one that serves the local consumer with the trust and dedication you would want for your family.

[1] Humana bought out the remaining 60% in 2021 and then divested a portion of Kindred in 2022

[3] Optum acquires Houston-based Physician Group for $2 Billion

[4] https://www.beckerspayer.com/payer/unitedhealth-ceo-optum-won-t-build-hospitals.htm