Collaborative Medicare Advantage payer partnerships and provider-sponsored senior health plans are gaining traction across the country as a critical strategy for profitable, value-based care. However, many organizations underestimate the necessary lead time and effort required to move from consideration to activation. Evaluating a 2024 plan launch or market introduction should begin immediately to assess if it could be a valuable strategy for the communities you serve.

In recent years, due to increasing cost pressures and enhanced competition among providers, many organizations have expressed their ambitions to develop their own health plans, often referred to as provider-sponsored health plans (PSHPs). Medicare Advantage (MA) is often considered the entry point of choice due to government financial incentives and strong opportunities to drive improvements in both quality and total cost of care for an increasingly aging population. Coupled with surging consumer preference for the program due to attractive benefits, it is no surprise that many organizations are interested in exploring the development of a consumer-centric, senior strategy attached to their strong local market brand. However, due to competing priorities, many executives struggle to carve out the necessary time to truly evaluate the opportunity, or falsely perceive limited possibilities due to an imprecise perception of capital investment required and regulatory risk involved to obtain such a strategically differentiated and provider-centric economic advantage in their market.

What Are My Organization’s Options?

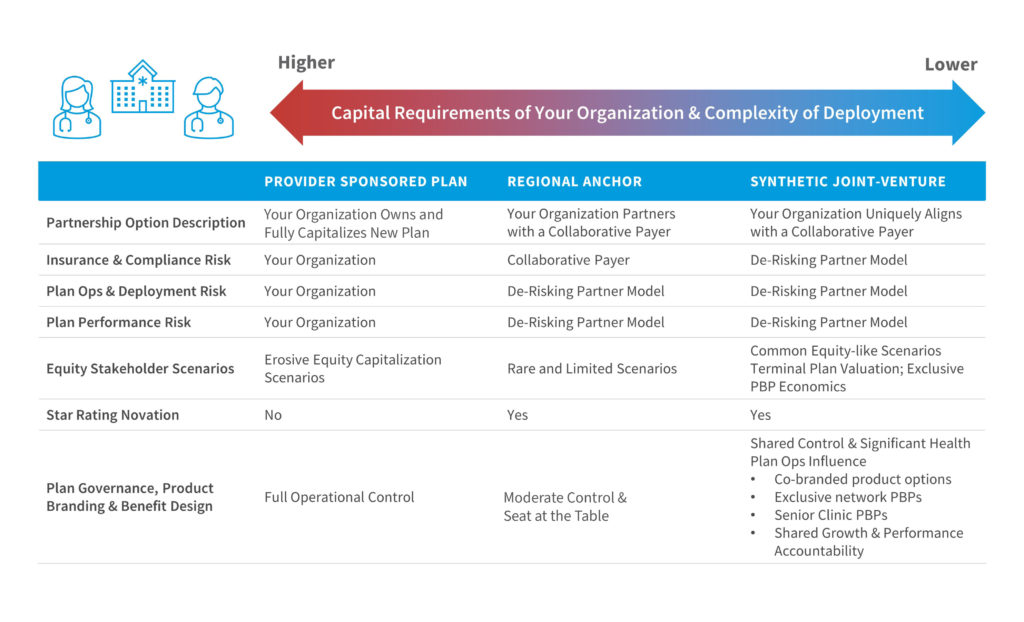

There are multiple strategic and structural options that can enable your organization to sponsor a collaborative Medicare Advantage plan into your region to advance a market-differentiated senior population strategy. In addition to the traditional, capital and resource-intensive provider-sponsored health plan (PSHP), an organization can form a joint-ventured entry, or identify and forge an altogether differentiated relationship with a collaborative payer partner looking to transparently align incentives, coordinate operations, and engage providers to deliver higher quality, cost-effective care.

What Exactly Is a Collaborative Payer and How Is It Defined?

Provider groups and health systems are finding that managing senior populations effectively requires tightly aligned care delivery business models and a collaborative payer to support the operational capabilities required of managing risk successfully. Many payers lack the traits of being a collaborative partner, and providers have seen limited success in achieving substantial value-based objectives. A collaborative payer is a true partner that invites the provider to sit on the same side of the table and co-design bespoke, market-differentiated products tailored to the organization’s providers, consumers, and community. This includes a focus on:

Aligned incentives: Contrary to the traditional win-lose approach to contracting, a shared focus on both financial and clinical outcomes is necessary for sharing risk with providers. Successful collaboration starts with aligned incentives—among the payer, provider, and consumer. Collaborative payers work with providers by offering:

- Win-win contracting

- Balanced provider incentives across quality, cost, and access

- Measurable and achievable 5-Star metrics

- Consumer benefits aligned with population health goals

Coordinated operations: Health plan operations must facilitate effective payer-provider collaboration, minimize physician abrasion, emphasize consumer satisfaction, and promote cost-effective, high-quality care. A collaborative payer will focus operations on:

- Timely and actionable clinical and financial data

- Coordinated programs avoid duplication and minimize friction

- Data-driven continuous 5-Star improvement

Engaged providers: A payer’s success is dependent on the provider groups’ success. Collaborative payers will partner with providers on:

- Education and training in value-based care

- Practice transformation support and resources

- Best practice sharing

What Options Are Ideal for My Organization?

How Do I Compare and Assess the Relative Opportunities (and Risks)?

Regardless of the preferred structural option, capital position, and risk profile, we believe it is imperative to thoughtfully begin designing an integrated and singular senior strategy with Medicare Advantage as a critical building block for your organization’s senior portfolio strategy.

As the Medicare population continues to grow and CMS expands its focus on controlling costs, providers can expect a doubling down of population health initiatives and a need for health systems to capture a larger share of the premium dollar. Medicare Advantage has always been a critical aspect of organizations’ population health strategy and will only enhance its position for the foreseeable future.

Many providers have recognized the opportunity present through Medicare Advantage and thus have been preparing for a migration up the Medicare food chain. As detailed above, there are different ways for organizations to accomplish this and share significantly more of the premium dollar: launch their own MA plan and accept full risk (and reward) or identify and partner with a collaborative payer in the market.

What Should My Organization Do Next?

Act…Evaluate! Whether it is launching your own branded Medicare Advantage plan to fully optimize your existing population share or integrating a collaborative plan to build the roadmap for a uniquely differentiated economic advantaged relationship with an aligned payer partner willing to co-design the full go-to-market strategy with you, the perpetual “few years down the road” process starts right now. A candid evaluation of your organization’s senior strategy and optimization possibilities takes time and thoughtful consideration.

The question to ask is not simply: “Can we introduce and launch a new plan?”

Strategic questions of equal importance are: “Should we introduce and launch a new plan? Will the market support a new offering? How will our competitors, contracted payers, and aligned providers respond? How collaborative are our existing payers? How will we advantage a new plan offering economically and operationally? Will we need partners? What kind of optionality should we be considering and planning for?”

The continual shift to value requires the ability to understand and manage significant risk. In many cases, it could be argued that not evaluating shifting market opportunities and preparing your own front-footed senior strategy could represent the greatest risk of all.

—————–

The upcoming Notice of Intent to Apply (NOIA) submission for a 2024 Medicare Advantage contract is due to CMS in November, 2022. However, with the present market dynamics and disruptors, regulatory initiatives, and continued demographic evolution, it has never been more important to assess options for plan year 2024—and that process needs to start soon to consider all options for 2024.

| Projected 2024 Launch Schedule* | Timing |

| 2024 MA Evaluation Window | Summer-Fall 2022 |

| Notice of Intent to Apply (NOIA) deadline | November 2022 |

| Applications posted by CMS | January 2023 |

| Plan application & Contracted network submission deadline | February 2023 |

| Bid submission to CMS | June 2023 |

| Annual enrollment period (AEP) | October-December 2023 |

| Plan go-live | January 2024 |

*The guidance set forth is subject to change per CMS guidelines and program requirements.