Healthcare is hard. While the American healthcare industry is filled with complexity as it seeks to interweave between multiple care delivery settings, care providers, and payment mechanisms – it points out the obvious that many new entrants into the industry experience: Making changes in healthcare and obtaining winning results is hard.

With Medicare as typically the largest payer for providers, the Centers for Medicare and Medicaid Services (CMS) has the best opportunity to succeed in transforming the industry to a value-based-driven system. As Medicare moves markets in risk-bearing arrangements, commercial carriers will begin to adopt provider accountable care programs that will include risk/reward opportunities. That said, CMS carries the burden of catalyzing change, and that comes with hard decisions and actions to reconstruct incentives.

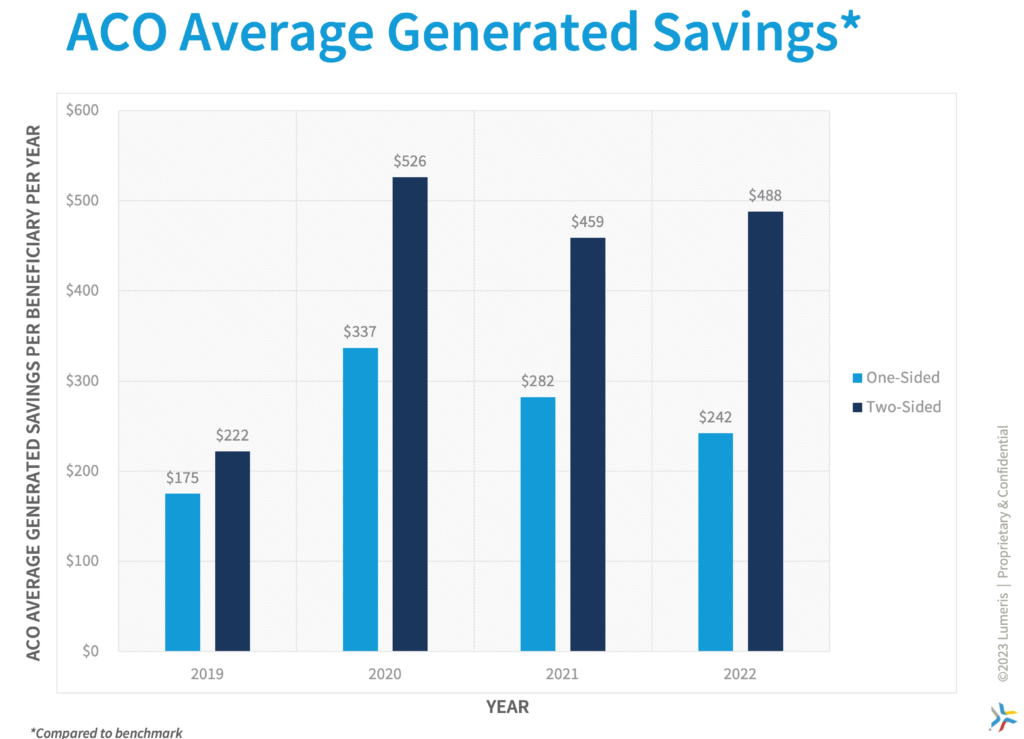

CMS has created programs to nudge providers to take on greater risk responsibility while giving them the opportunity to obtain greater rewards with more levers to manage risk effectively. In doing so, the market has had several years to experiment with ‘two-sided’ or programs with both up- and down-sided risk, and the results are in…

Two-Sided Risk Performance

In the recently released Medicare Shared Savings Program 2022 results, two-sided risk Accountable Care Organizations (ACOs) generated savings over double the amount per beneficiary compared to their one-sided counterparts. These ACOs generated per beneficiary savings (ACOs whose savings or loss rates equaled or exceeded their minimum thresholds) of approximately $488[1] per beneficiary per year (PBPY) compared to $242 PBPY for upside only ACOs. Medicare’s Shared Savings Program (MSSP) took a more assertive stance when driving providers toward managing downside risk that results in a balance of rewards but also accountability to effectively manage this population within a provider’s greater patient panel. The model guided providers along a continuum, ranging from the Basic track, which included models A through E, to the Enhanced track. The Enhanced track was designed for ACOs with enough experience to manage greater downside risks, potentially yielding greater rewards with upside. Those within the Enhanced track generated savings of $528 PBPY compared to $429 PBPY in the other two-sided risk tracks.

Sustaining Medicare

As the nation continues to evaluate programs to manage the substantial annual spending on healthcare, we are by no means ‘out of the woods’ yet. The Medicare Board of Trustees’ annual report to Congress recently released its expectation of solvency of the Medicare Trust Fund (MTF). The MTF is expected to be insolvent by 2031: an extension from a near miss in 2026. Still, we don’t have much time to fix the ails of the system, nor do we need a leading economist or health professional to tell us that the system is not sustainable. But we do need leadership across the healthcare ecosystem to galvanize more meaningful dedication toward keeping people healthy and moving providers away from sick care. One of the ways to effectively do this is to double down on the value-based care movement and truly have everyone be accountable to the care model. This movement effectively aligns incentives to keep people healthy and make providers financially whole by participating in keeping them healthy.

As we navigate the aftermath of a pandemic and rising labor costs, now is the time to focus on innovation for the future of healthcare. Providers are looking for ways to diversify their revenue sources, obtain more consistent cash flows, and drive higher quality outcomes in their communities. However, playing it safe with maintaining the status quo is unsustainable. Reverting to backfilling revenues by expanding capacity with new bed towers, cost shifting strategies of maximizing commercial volumes, and backfilling elective case deferrals is not a viable strategy for the long-term. Health delivery is moving closer to ambulatory and home more than ever. Meanwhile, consumers are calling for greater price transparency and accountability of managing quality and costs. Conversely, the strategy should be focused on seeking to be the consumer’s trusted partner, the partner who will drive value for them and their families, and the partner who will be accountable for managing costs and quality.

Additionally, 41% of MSSP ACOs in one-sided risk models generated savings (met or exceeded minimum savings rates) compared to 79% in two-sided risk models. The latter generated savings averaging nearly $620 PBPY compared to $560 PBPY for ACOs in upside-only tracks.

The results are similar in ACO REACH. Reviewing the latest publicly available performance data for the ACOs generated, on average, approximately $130 PBPY in shared savings by managing total cost of care for Medicare FFS beneficiaries. Additionally, 38 of the 52 ACOs (72%) in REACH generated shared-savings payments averaging approximately $450 PBPY[4]. Since Pathways to Success 2019 inaugural year and the first performance year of ACO REACH, two-sided risk ACOs have notably outperformed upside only ACOs. The move to encourage two-sided risk management is both desired and needed to adequately align incentives.

It is understood that the organizational structures between ACOs, especially between physician-owned and hospital-owned ACOs, can differ. Hospital-owned ACOs have a high-cost set of acute assets to maintain an adequate revenue stream, such as inpatient and post-acute settings. That said, even hospital-anchored ACOs (high-revenue categorization as a proxy) that participated in two-sided risk accrued significant differentiation on savings if they took two-sided generating $358 PBPY vs. $177 PBPY in 2022. Ensuring universal accountability, particularly in inpatient setting management, is crucial. Although some are unprepared for immediate two-sided risk, it’s key for leaders to develop these abilities, given the business necessity of revenue diversification and a shifting business model toward premium management.

Driving Toward the Future

Driving change won’t come easy, and there will be barriers to adoption and from competing commercial interests. However, the system needs to evolve with financial accountability as a core competency to continue producing results. Activating value-based programs while inviting more risk in exchange for greater rewards will deliver better results and earnings for providers in addition to being a win for both taxpayers and consumers. The results of the Center for Medicare and Medicaid Innovation (CMMI) two-sided risk models are clear: when quality and financial incentives are aligned to empower providers to appropriately manage and coordinate care, we begin to see a meaningful and effective adoption of value-based principles.

The uber-competitive private commercial and Medicare Advantage space has seen a proliferation of disrupter entrants and vertical integration. The major players have taken notice of these results and are looking for experienced, high-performing integrated delivery networks to partner within battleground markets. Provider networks and health systems late to the game may find themselves on the outside looking in when it comes to favorable contracts as the players in these lines of business accelerate adoption of two-sided risk to better manage quality and utilization. The proverbial tipping point of shifting from fee-for-service to value-based care we’ve long awaited might be closer than we think. Policymakers and industry leaders must continue to play their part in sustaining and accelerating this momentum toward widespread adoption.

References

[1] CMS 2022 Performance Year Financial and Quality Results. Lumeris Analysis.

[2] https://innovation.cms.gov/media/document/aco-reach-model-fast-facts

[3] The Medicare Shared Savings Program instituted updates to its program design that began calendar/performance year 2019 and the programmatic title of these changes is “Pathways to Success”

[4] https://innovation.cms.gov/innovation-models/gpdc-model. 2021 PY Results.